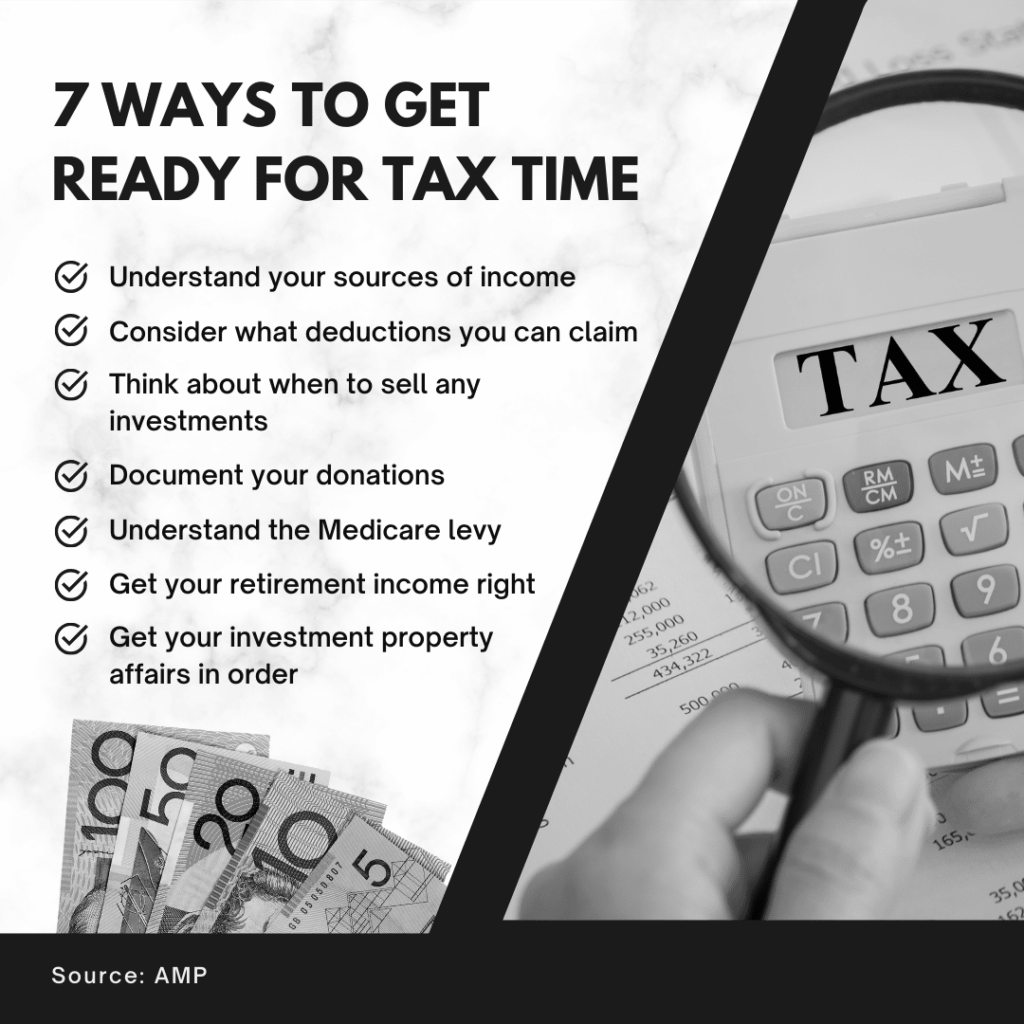

Here’s a quick checklist to help you prepare for the end of financial year and maximise your tax time benefits.

1. Understand your sources of income

When it comes to tax, your wages are just the start. Income can come from all sorts of areas.

- Interest you’ve earned from bank accounts.

- Dividends you’ve received from shares.

- Employee share options you may be entitled to.

- Capital gains you’ve received from the sale of an asset.

- Rental income from an investment property.

- Redundancy payments when you’ve left a job.

- Any taxable Centrelink payments you may have received.

2. Consider what deductions you can claim

The rules around work related expenses do change from time to time so make sure you check what you can claim, particularly if you’ve been working from home more over the past couple of years. And did you realise you may be able to claim a tax deduction from super contributions? You may be eligible for a tax offset of $540 if you make a super contribution for your spouse and your spouse’s income is under the relevant threshold.

3. Think about when to sell any investments

Stick or twist? Sell or keep hold? When it comes to how capital gains from selling an asset are taxed, timing is everything – whether it’s a parcel of shares, an old car or even an investment property. Don’t forget the upcoming tax changes may mean that from 1 July you’re paying less tax, so that might affect when you decide to divest any investments and incur a capital gain – this year or next.

4. Document your donations

It’s great to give to your charity of choice but don’t forget your potential tax deductions. So hang on to your receipts and keep a record of your donations.

5. Understand the Medicare levy

If you earn over a certain amount you’ll need to pay the 2% Medicare levy to help fund the private health system. But there’s a potential rebate available if you take out private health insurance. So you might want to work out your best approach, particularly as you make progress at work and start to earn more money.

6. Get your retirement income right

If you’re retired, the good news is you can potentially earn a higher level of income before you start paying tax. But it can depend on your age and the type of income you receive.

7. Get your investment property affairs in order

If you’re renting a property out then you’ll probably be aware there are plenty of tax deductions you can claim for things like depreciation, cost of repair and maintenance, interest costs on your loan and fees that you pay for a real estate agent to manage your property.

Source: AMP