Outliving your savings

While living a long and healthy life is a goal for most of us, it does raise a valid question. Is there a chance that you could outlive your savings?

The money conversations you need to have

When was the last time you talked about money? You might struggle to remember. Your personal finances or debt position are hardly dinner party material but there are plenty of other reasons we don’t often talk about money.

How to give your finances a health check

How healthy are your finances? Isn’t it time you put your own financial wellbeing front and centre? You can take control of your financial future quickly and easily, with a simple financial health check.

Just like your physical health, it’s worth giving your finances a checkup once in a while. Over time, unhealthy spending habits can creep in, threatening to derail your progress. Here’s how to give your finances a health check and find out where you can make some healthy gains.

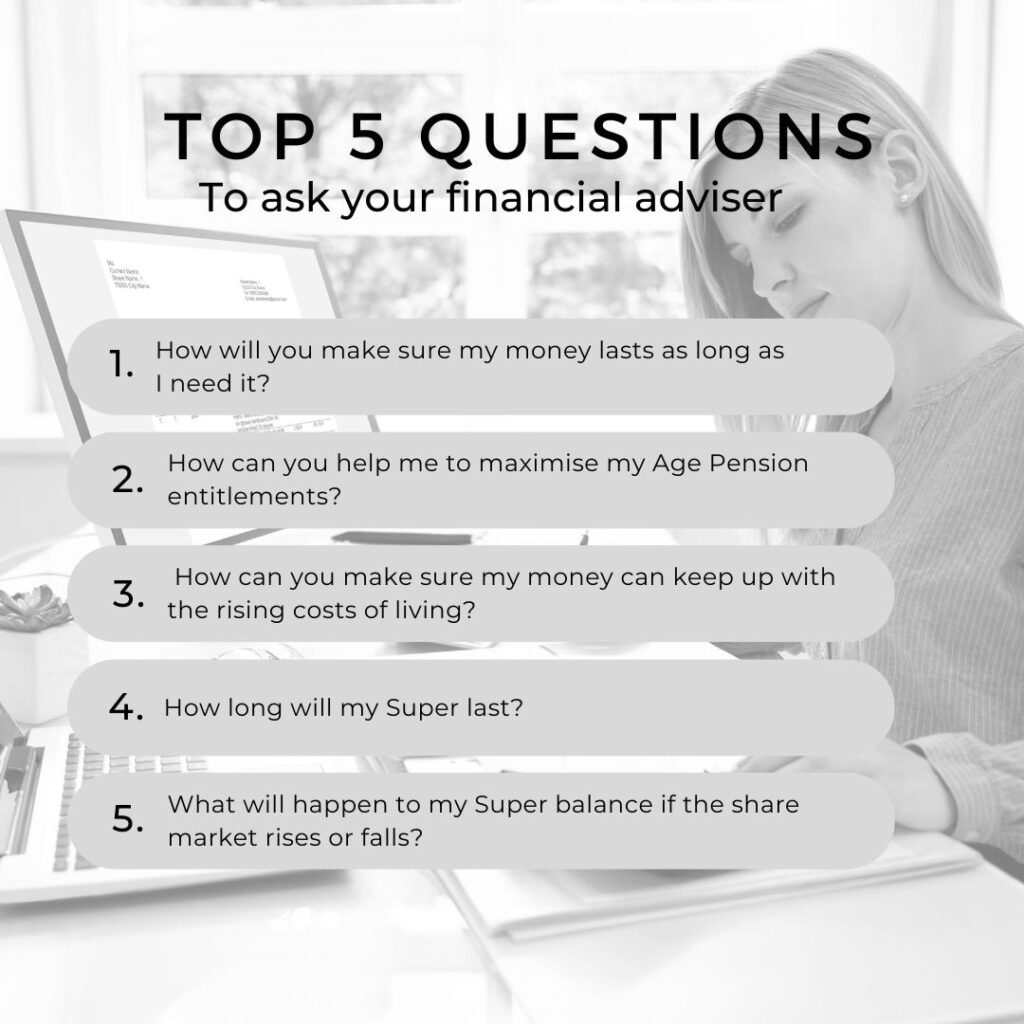

Top 5 Questions To Ask Your Financial Adviser

Getting smart about savings

Saving money doesn’t come naturally to everyone. Some people are wired to save – for others it takes a bit more discipline; but developing good savings habits can do so much for both your financial wellbeing and your future security.

What you should know about creating your will and estate plan

If you want to protect your family and assets, it’s worth documenting what you’d like to happen if you can’t make your own decisions later in life or if you pass away.

If you’ve got people in your life who you love and assets you’d like to be distributed in a certain way, you might be at a point where you’re thinking an estate plan would probably make good sense.

What’s super and how does it work?

A helpful guide to understanding the basics of super.

Will you be able to afford to retire?

FORO – the fear of running out – is a very real issue in Australia. AMP’s Financial Wellness research indicates that almost 50% of Australians are worrying that they don’t have enough money for retirement.

8 indicators you may not be ready to retire

Retirement is a period of life that many people spend years dreaming about: the chance to finally leave work behind and enjoy much-needed time with family and friends. While it’s natural to be excited about retirement, it’s worth getting all your ducks in a row before you say goodbye to work – and a regular income – forever.

What is financial planning?

If you could achieve your financial goals by simply putting money away in the bank, you wouldn’t need a financial plan. Unfortunately, life is a little more complex – it’s hard to understand the intricacies of investment, taxation and ever-changing rules and regulations, so you may need help from a professional advisor.