How to upsize your super with a tax-free downsizer contribution

Did you know from age 55, you may be eligible to make a super contribution of up to $300,000 using the proceeds from the sale of your home?

Downsizing your home in retirement could have several upsides – some money in your pocket, less maintenance, and depending on your new location, greater convenience.

If it’s something you’ve thought about, particularly if you’d like more savings to fund your retirement, the government’s downsizer contribution scheme may be of interest.

Here’s what’s involved, what the potential benefits may be, and what you should consider.

Five tips for a better retirement

Retirement is an exciting time. It’s the long-awaited reward for a lifetime of work and, if you’ve planned it correctly, it heralds a life stage synonymous with relaxation and enjoyment.

Making downsizer contributions into super

If you’re over 55 and looking to boost your retirement savings, you may be eligible to make a super contribution of up to $300,000 from the sale proceeds of your primary residence.

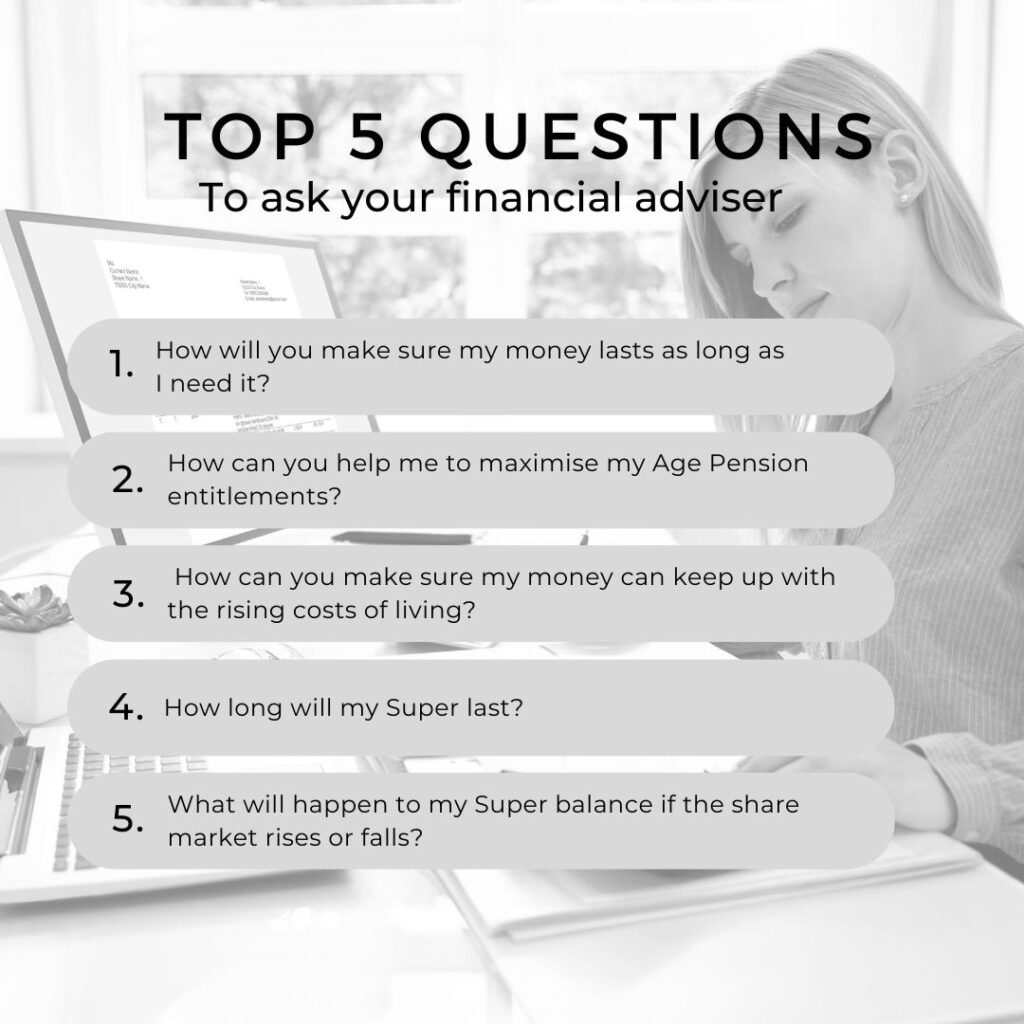

Top 5 Questions To Ask Your Financial Adviser

Retirement Planning E-Book

For some people, retirement means the ability to spend more time with loved ones,

while for others it may mean pursuing a neglected hobby or travelling the world.

For more information please find below the free e-book.

How to save for retirement in your 60s

Your 60s are the time in which you’re most likely to retire – according to the Australian Bureau of Statistics, of the Aussies who are planning their retirement, the average age they intend to retire is 65.5 years. But just because you’re getting close to retirement age, doesn’t mean you can afford to stop being proactive about building your nest egg.

Downsizing your home? Understanding the downsizer contribution

Understanding the downsizer contribution

Will you be able to afford to retire?

FORO – the fear of running out – is a very real issue in Australia. AMP’s Financial Wellness research indicates that almost 50% of Australians are worrying that they don’t have enough money for retirement.

8 indicators you may not be ready to retire

Retirement is a period of life that many people spend years dreaming about: the chance to finally leave work behind and enjoy much-needed time with family and friends. While it’s natural to be excited about retirement, it’s worth getting all your ducks in a row before you say goodbye to work – and a regular income – forever.

7 age pension traps to avoid

After a lifetime of hard work, it’s important you maximise your entitlements in retirement. So you need to structure your finances carefully to make sure you don’t lose your age pension. After all, you’ve earned it. Here are some common traps to be aware of.