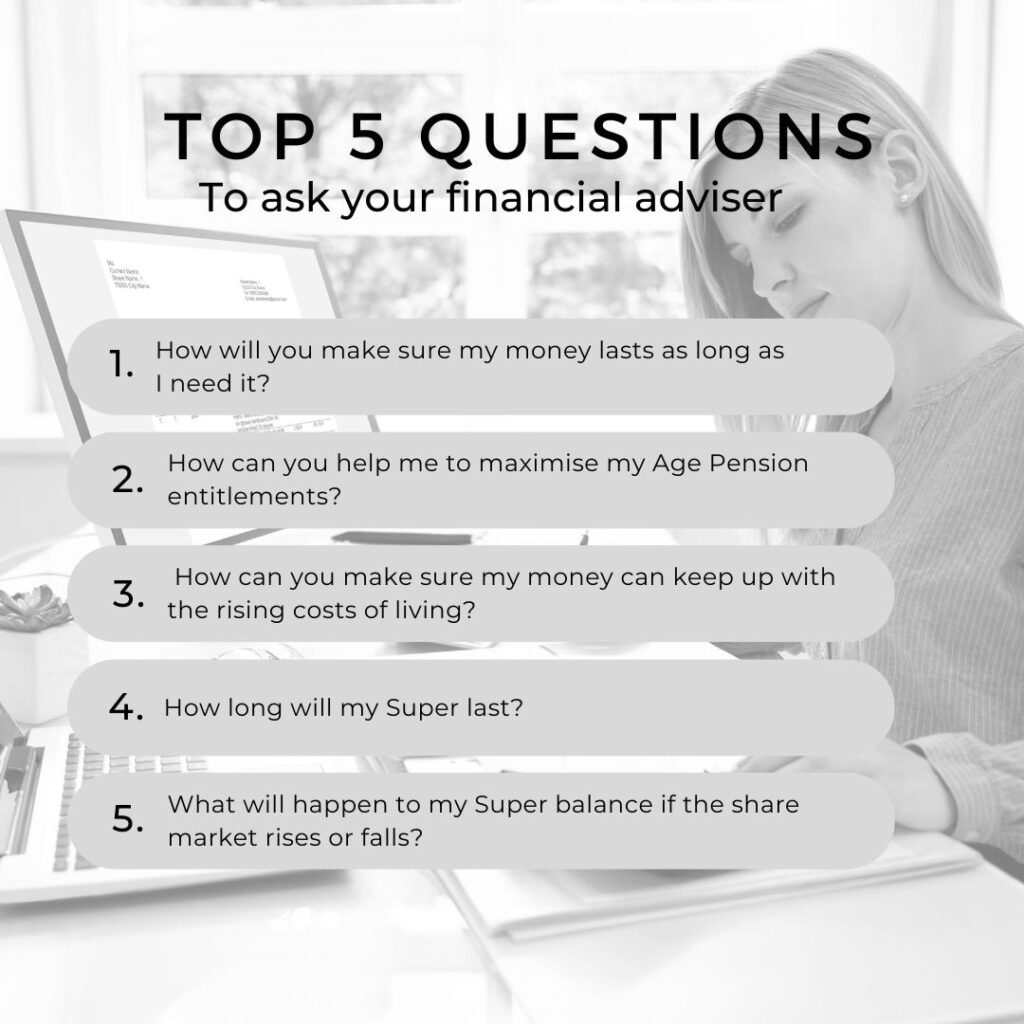

Top 5 Questions To Ask Your Financial Adviser

Retirement Planning E-Book

For some people, retirement means the ability to spend more time with loved ones,

while for others it may mean pursuing a neglected hobby or travelling the world.

For more information please find below the free e-book.

How to save for retirement in your 60s

Your 60s are the time in which you’re most likely to retire – according to the Australian Bureau of Statistics, of the Aussies who are planning their retirement, the average age they intend to retire is 65.5 years. But just because you’re getting close to retirement age, doesn’t mean you can afford to stop being proactive about building your nest egg.

Downsizing your home? Understanding the downsizer contribution

Understanding the downsizer contribution

Will you be able to afford to retire?

FORO – the fear of running out – is a very real issue in Australia. AMP’s Financial Wellness research indicates that almost 50% of Australians are worrying that they don’t have enough money for retirement.

8 indicators you may not be ready to retire

Retirement is a period of life that many people spend years dreaming about: the chance to finally leave work behind and enjoy much-needed time with family and friends. While it’s natural to be excited about retirement, it’s worth getting all your ducks in a row before you say goodbye to work – and a regular income – forever.

7 age pension traps to avoid

After a lifetime of hard work, it’s important you maximise your entitlements in retirement. So you need to structure your finances carefully to make sure you don’t lose your age pension. After all, you’ve earned it. Here are some common traps to be aware of.

The RBA starts raising rates – how far and how fast? And what does it mean for investors?

For the first time since November 2010, the RBA has raised its official cash rate – from 0.1% taking it to 0.35%.

Should you use property to fund your retirement?

Aside from simply owning a secure place to live through retirement, investing in property can also provide regular post-work income and might offer some assurance as a ‘safe’ investment option.

How does your pension live on after you die

In this article, we examine the nomination of an individual beneficiary, where the nomination of a member’s estate and a reversionary beneficiary nomination is not in place.