Five rules of money management

No matter your income level or financial goals, everyone can benefit from developing strong money management skills. Here are five rules of money management that can help build a solid foundation for financial wellbeing.

Getting smart about savings

Saving money doesn’t come naturally to everyone. Some people are wired to save – for others it takes a bit more discipline. But developing good savings habits can do so much for both your financial wellbeing and your future security.

How to give your finances a health check

How healthy are your finances? Isn’t it time you put your own financial wellbeing front and centre? You can take control of your financial future quickly and easily, with a simple financial health check.

Just like your physical health, it’s worth giving your finances a checkup once in a while. Over time, unhealthy spending habits can creep in, threatening to derail your progress. Here’s how to give your finances a health check and find out where you can make some healthy gains.

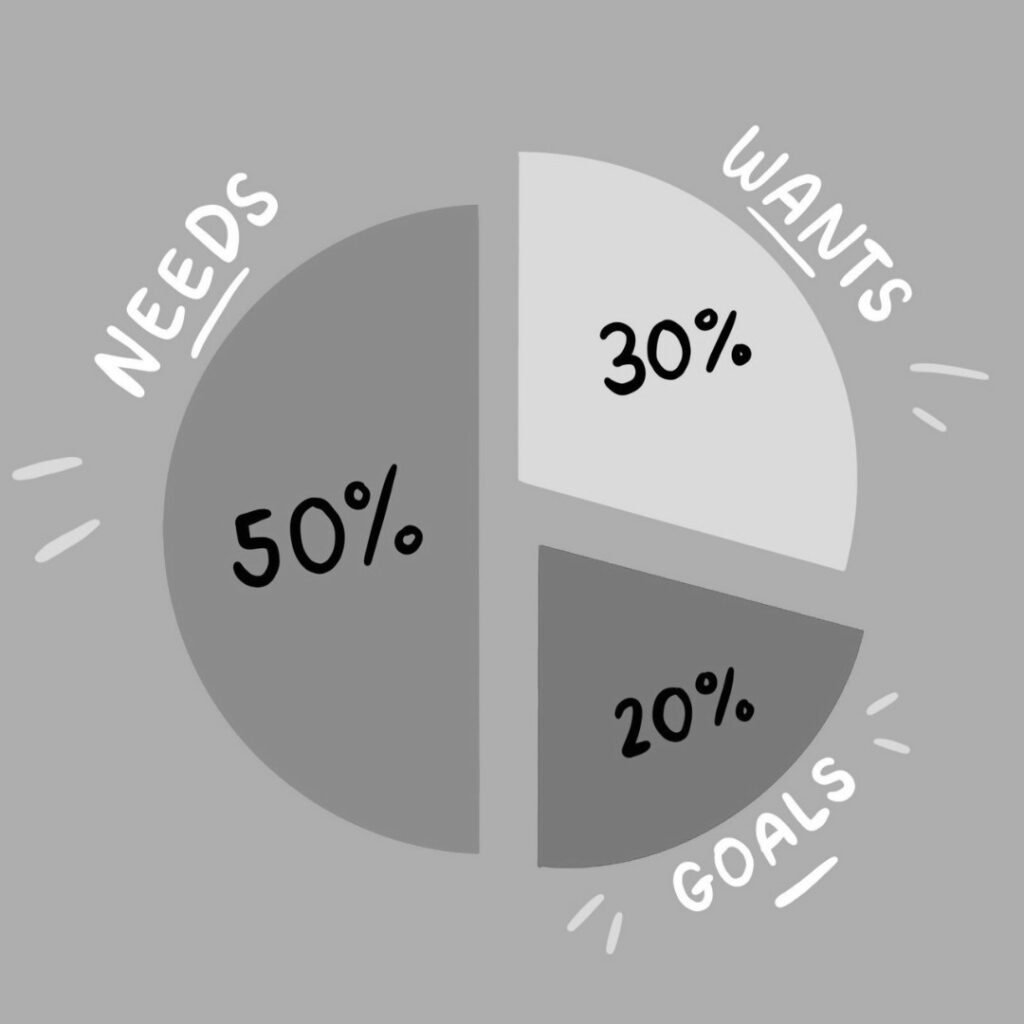

50/30/20 budgeting strategy

Having a budget can help you stay on top of bills, pay off debt and save for long or short-term goals. There are many ways to go about it.

One budgeting strategy is the 50/30/20 approach, which requires you to designate a portion of your earnings to three categories.

Christmas Spending Without the Splurge

Based on my position as a financial planner, it would be expected of me to suggest that Christmas expenses form part of the annual household budget. Ensuring that Christmas is included in your cashflow requires you to consider Christmas costs throughout the year and set aside an amount each week or fortnight to ensure you have your Christmas shopping budgeted for.

Where does all my money go? Save money on your three biggest expenses

The three biggest drains on our money are paying for housing, food and transport; and there’s no getting away from the fact that it is unlikely we can live without any of the ‘big three’. Here we look at some ways of how to save on these items.