There is no magic age at which to retire. But what’s important is to plan for a longer retirement than you may expect. This is in part because research shows we’re now living longer than ever. According to the Australian Government Actuary (AGA), factoring in improvements in life expectancies over the last 25 years, half of today’s 65-year-olds will live to at least 87 for males and at least 89 for females.

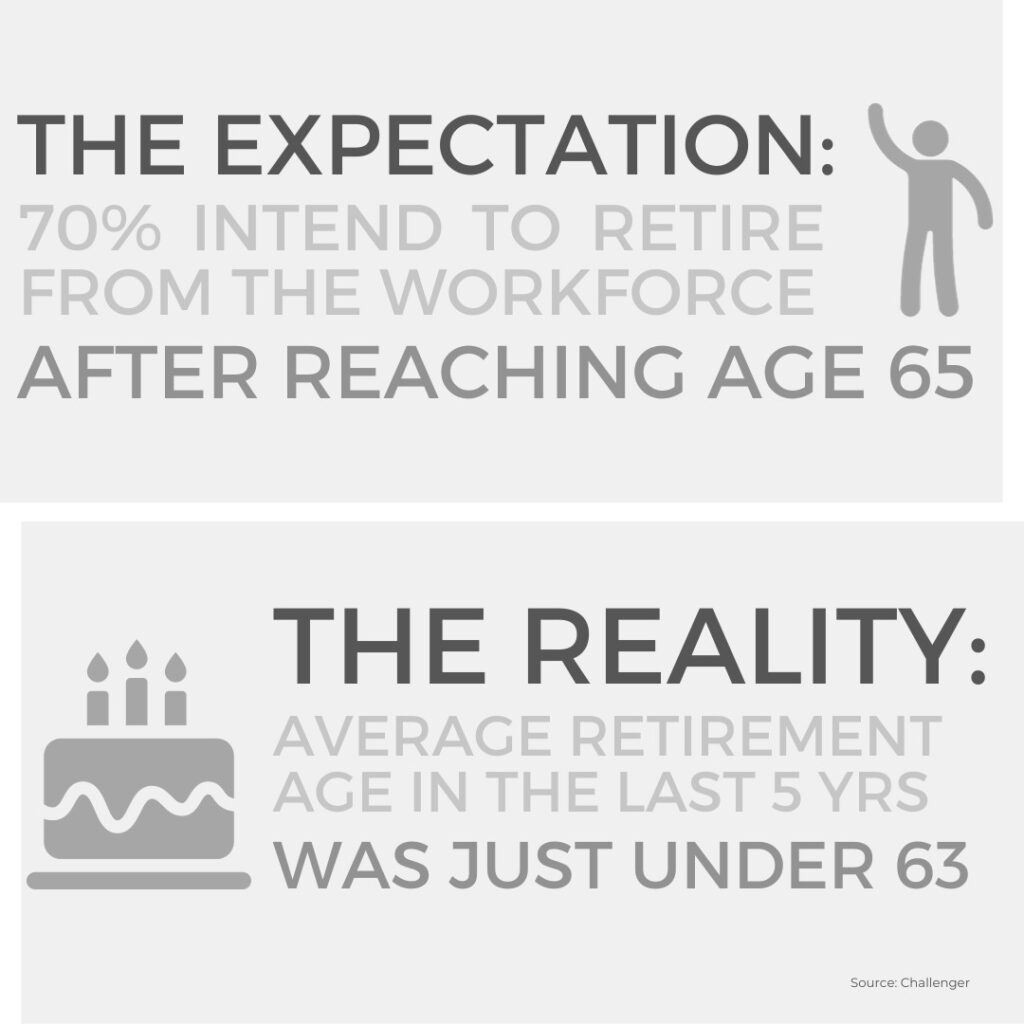

At the same time, we also spend a considerable part of our lives retired. According to the Australian Bureau of Statistics, the average age at retirement for recent retirees (those who have retired in the last five years) is approximately 63 years. Most Australians will therefore spend at least 25 years in retirement.

This means we need to think about how we will support ourselves financially after we leave work. This involves considering whether we need to work longer than we may have expected, and the goals we have when we do finish work.

When to start your retirement?

National Seniors’ CEO, Professor John McCallum, says there is now a lot more flexibility around when to leave work.

“Many people retire at around 60 or 65, but some people are happy to work into their 70s and beyond”, McCallum says. “The world has changed”.

He says often people reach a point at which they want to spend more time with their grandchildren or do other things, which becomes a catalyst for retirement.

Marney Perna, who is preparing for retirement, says the best age to retire depends on the person. “I want to enjoy my retirement. I want to ensure I’m fit and healthy. I don’t want to be in a position where I’m working into my 70s, but I can’t enjoy my retirement because my health deteriorates suddenly”.

It is important to consider how you will fund your retirement well before you leave work for the last time. This means thinking through the retirement lifestyle you would like to enjoy many years beforehand.

“Consider what your retirement future entails, and how much money you’re going to need for that. Take time early in your life, even in your 40s, to think this through. My husband and I started planning for our retirement when we got married in our 20s”, Perna says.

“We never wanted to rely on the Age Pension. We’ve always factored in saving for our future. But we’ve also trusted our own judgment. If we wanted to buy a car, we ensured we could. But we also had our financial future in mind”.

Often people do not choose when they retire. Rather, circumstances force their hand, for instance as a result of health issues or a redundancy. According to a 2019 survey by YourLifeChoices, 50 per cent of Australians were influenced by work availability or health reasons when considering when to retire.

Building the right plan

To ensure you have sufficient funds in retirement, the first step is to map out a budget to work out how much money you’ll need to live on each year.

According to the Association of Superannuation Funds of Australia’s Retirement Standard, to have a comfortable retirement, single people will need $595,000 in retirement savings and couples will need $690,000.

The confidence to spend

Finding ways to consume retirement savings safely and steadily over a lifetime is a priority for most retirees. One way to do this is with a lifetime annuity, which provides regular payments for life. Annuities can give you peace of mind and confidence in retirement.

According to a recent National Seniors Australia report, Feeling financially comfortable, people with a secure income for life have higher levels of financial comfort than those with market-linked retirement savings.

John McCallum agrees annuities play an important role in giving people confidence they will have enough money in retirement.

“Annuities give you an additional layer of protection for life, or for a chosen investment term. Lifetime annuities also receive favourable treatment for Centrelink purposes. They can help retirees increase their Age Pension entitlements.

“They are a critical part of the solution for people without a defined benefit pension and considerable wealth, especially considering the high cost of health and aged care during retirement. A lifetime annuity may mean that you have regular income to help fund your essential expenses during retirement” he says they will become even more essential as baby boomers age.

“The world is changing and people want a better lifestyle in retirement. The government only provides the basics and an annuity can help support retirees’ lifestyles over time”.

Source: Challenger