Will I pay tax on my super when I retire?

Tax is often the last thing on our minds when we’re planning for retirement but it’s important to understand how your retirement income will be taxed, so you can make the most of your savings.

Commonly Asked Questions – retirement planning

Retirement planning doesn’t end when you stop working; in fact, it becomes even more pressing as you move into this new phase of life. Here are a few steps for retirees to grow their money in retirement:

Do you know your Total Superannuation Balance (TSB)? You should!

The total superannuation balance or TSB was a significant change introduced as part of the Government’s superannuation reform package, taking effect on 1 July 2017. However, unlike other changes, such as the pension transfer balance cap, the total superannuation balance has generally been overlooked despite its broad implications.

Outliving your savings

While living a long and healthy life is a goal for most of us, it does raise a valid question. Is there a chance that you could outlive your savings?

Reducing risk in retirement

We all think things will turn out better for ‘us’ than ‘them’. Such optimism can serve us well in life, but when it comes to money, balancing bias with facts is a much safer option.

When it comes to your retirement there are four main risks that can impact your income

Maximising wealth together: Super contributions for your spouse

Maximising super contributions for your spouse is a smart financial move that can benefit both your partner and your family’s long-term financial security. By actively contributing to your spouse’s super account, you not only help them build a more substantial retirement nest egg, but also enjoy potential tax benefits in the process. However, it’s essential to understand the eligibility criteria, contribution limits, and potential implications on other aspects of your retirement plan and estate planning.

What to do if you’re 55 and have no retirement plan

Retirement planning is one of those things that often gets pushed to the back burner. When you’re young, it’s easy to convince yourself that retirement is light years away and you’ve got plenty of time to figure it all out. But life has a habit of going by real fast and all of a sudden, you’re 55 (or thereabouts) and realise that retirement is just around the corner.

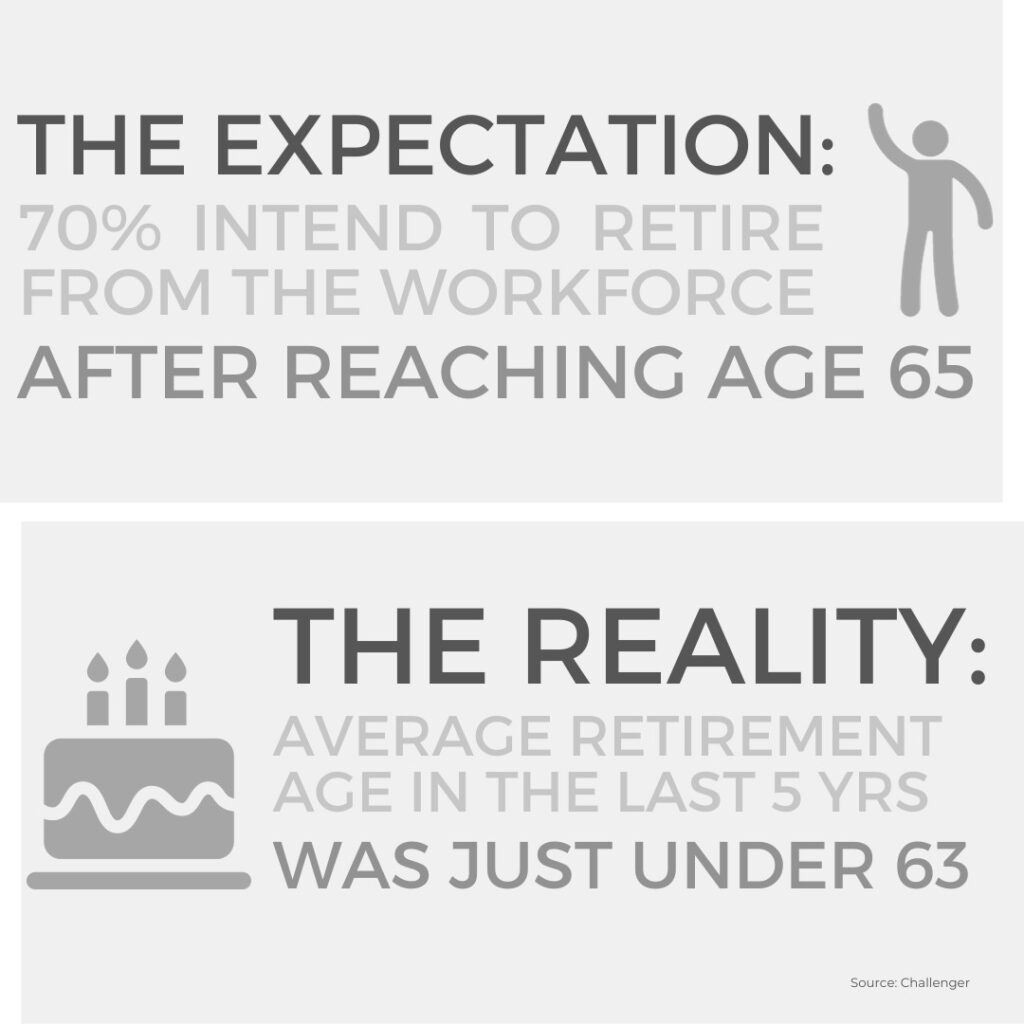

What’s the best age to retire?

There is no magic age at which to retire. But what’s important is to plan for a longer retirement than you may expect. This is in part because research shows we’re now living longer than ever. According to the Australian Government Actuary (AGA), factoring in improvements in life expectancies over the last 25 years, half of today’s 65-year-olds will live to at least 87 for males and at least 89 for females.

Help your retirement funds last the distance

Retirement is a time that many Australians eagerly anticipate, providing plenty of time to pursue hobbies, do more travelling, or simply kick back and enjoy the fruits of your labour. We will outline key strategies to help boost and preserve your retirement savings, to help you achieve long term financial security throughout your golden years.

Elder financial abuse

Elder financial abuse can happen to anyone at any time. Learn how to recognise the signs and equip yourself with the knowledge to minimise the risk of it happening to you.